Let’s discuss the impact and implications of indirect taxes on your organization. Direct vs. Indirect Taxes Before we talk about how indirect taxes shape businesses, let’s break down the difference between direct taxes and indirect taxes. According to the IRS, “a direct tax is one that the taxpayer pays directly to the government. These taxes cannot be shifted to any other person or group. An indirect tax is one that can be passed on – or shifted – to another person or group by the person or group that owes it.” Examples of direct taxes include things like income taxes, property taxes, and taxes on assets. Indirect taxes include things like sales tax, value-added tax, and other excise duties, where a tax is collected by the seller but paid by the buyer. Most indirect taxes are paid by consumers, not by the supplying business. The Impact of Indirect Taxes Indirect taxes are often used by governments to encourage – or discourage, in the case of sin taxes – certain behaviors in consumers. For example, taxes imposed on items being imported can help push US consumers to think more carefully about buying American-made products. These products are often cheaper because the extra indirect tax does not apply to them. This, of course, depends on the costs associated with making and shipping a product within the US versus from country to country. Indirect taxes also allow businesses to allocate certain financial burdens, operations, and cost analysis away from the business itself and onto your customers, easing your financial burdens and increasing revenue. But the digital transformation that has been in the works for years before COVID is going to create a lot of new obstacles and opportunities. The Emergence of NFTs Non-fungible tokens are becoming more and more popular, as is cryptocurrency. NFTs are unique digital assets whose ownership is demonstrated and verified via DLT (distributed ledger technology). Because NFTs are difficult to classify, they are …

Mortgage Interest & Taxes in 2022

The latest version of Form 1098 is available from the IRS for tax season 2022. Get to Know Form 1098 There are seven different types of 1098 forms, but the one we wanted to talk about today is the original, the plain 1098. Form 1098 is used to help report mortgage interest. The last year or so has seen a tumultuous housing market, with home prices rising to astronomical prices due to drastic upticks in demand and inflation. Mortgage interest deductions, like those categorized and reported on form 1098, are not all-encompassing. The IRS defines mortgage interest as interest that is accrued from a loan that originates on your primary or secondary home. A mortgage interest that qualifies for deduction includes: Any interest on your home, which is defined as a property that includes sleeping, cooking, and eating facilities: house, condo, co-op, mobile home, boat, or recreational vehicle Interest on a second home that is not being rented out (there are specific guidelines for those who rent their homes seasonally and in other piecemeal situations Most mortgage insurance premiums Late payment fees Prepayment penalties Points Home equity loans and home equity lines of credit: if you took out a home equity loan to finance a remodel (a common occurrence with the rise of COVID and the work-from-home boom), you can deduct interest on the amount you used for the renovation Unfortunately, there are several things that are not deductible when you file a 1098, including mortgage interest on a third or fourth home, reverse mortgage interest, homeowners’ insurances, appraisal and notary fees, down payments, closing costs, home equity loans, and equity loan funds that were not used on the property. If you worked from home last year, you’ll have to get measurements and do some calculations because you can claim the space in your house that was used for living, but not the space you used for work (this is the opposite of a home office …

Publication 1220 for Tax Year 2021

The IRS recently released Publication 1220 for the tax year 2021. Here’s what you need to know. What is Publication 1220? IRS Publication 1220 is a document released yearly that lays out the specifications for the electronic filing of the following forms (you can see the full list on page 9 of the publication itself): 1097 1098 1099 3921 3922 5498 W-2G If your business – whether it be a corporation, partnership, employer, estate, and/or trust – is required to file 250 or more information returns in a calendar year, you must file electronically using the FIRE (Filing Information Returns Electronically) System by way of a TCC (Transmitter Control Code). While it’s not required, all businesses that have fewer than 250 are also encouraged to e-file their forms and keep that data safely stored so as to discourage fraudsters. Updates for Tax Year 2021 Since the original document is a 163-page PDF, we thought we would break down some of the biggest updates to Publication 1220 for the tax year 2021. First and foremost, let’s talk about Form 1099-NEC. When the IRS released Publication 1220 for the tax year 2020 in October of that year, the newly revamped 1099-NEC was not included in the IRS 1099 CF/SF (Combined Federal and State Filing) Program. But that changes this tax season, as the NEC is now eligible for e-filing. Before we get ahead of ourselves, let’s talk about the conditions of this change. There are still 36 states plus the District of Columbia (as of December 2021) that have their own direct reporting requirements for the 1099-NEC that cannot be met through CF/SF. And there are a number of states – Alaska, Florida, Nevada, New Hampshire, South Dakota, Texas, Washington, and Wyoming – that do not participate in the CF/SF program at all but mandate direct reporting instead. It's also important to note that state-based electronic filing requirement updates must also be met, in addition to IRS guidance. Unfortunately, tax …

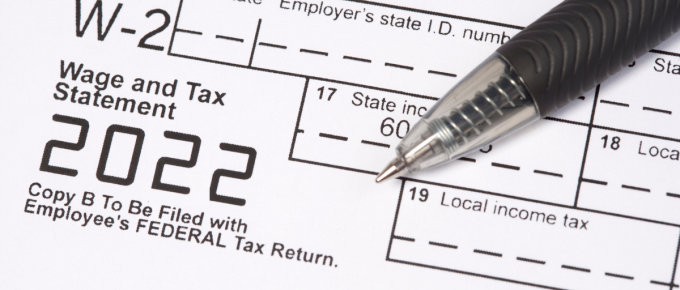

W-2 Compliance Insights

We are almost at the deadline for sending W-2s. If you’ve already sent them out, these W-2 compliance tips will be great for 2022 year-end. If not, you have a little bit of time left to tie things up and get them out to your employees. Employer Responsibilities As the employer who will be sending out the W-2s, you’re responsible for all the copies, as well. Copies B, C, and 2 are to be sent to your employee. Copy A goes to the Social Security Administration, Copy 1 is to be submitted to the state tax authority if applicable, and Copy D is for you to keep with your employer records. A single employer is only required to submit one W-2 per employee, even if the employee in question has worked in multiple roles. The only instances in which an exception would be made are if a single employee worked in multiple roles across different locations or if company ownership changed mid-year. In these special cases, W-2s must be issued for each different EIN (Employer Identification Number) that said employee worked for. Compliance and 2022 Changes The IRS recently published the Employer’s Tax Guide, which helps identify the items that employers are responsible for this tax season, as well as highlights the latest updates as they pertain to your business and operations. One update addresses the COVID-19 related credit given for sick and family leave wages. This credit is limited to leave that was taken after March 30, 2020, and before October 2021. The COVID-19 related employee retention credit has expired, and COBRA premium assistance payments credit is limited to coverage periods on or after April 1, 2021, through coverage periods that began on or before September 30, 2021. There are also some updates and reminders regarding Social Security and Medicare Tax, as well as deferment amounts of the employer share of these taxes. All of these insights can be found in the IRS 2022 Publication 15. Compliance Tips for 2022 Filing This year, employers are able to …

Tax Advisor Qualities to Look For

When you choose a tax advisor, you are not just choosing a contractor or service provider, you are placing all or part of your company in another professional’s hands. Here are some top tax advisor qualities to look for. They Work from Your Perspective As much as we’d all love for taxes to be more straightforward, they’re just not. And a good tax advisor will work to understand and create a tax prep strategy that takes your specific industry and business needs into account throughout the tax prep process. Since most tax laws are written to explain how you can reduce your taxes, having someone who understands these laws and how they can benefit your own taxes is a must-have trait when it comes to choosing the right tax advisor for you. One of the best ways to tell if a tax advisor is going to dive in eagerly and be committed to seeing the tax world from your business’s point of view is to ask them about their approach. If they want to know everything about you and your business, the ins and outs of your products, services, and operations, they are definitely off to the right start! They Want to Share Their Knowledge Gatekeeping may be a way to separate the experts from the amateurs, but this should not be a practice your tax advisor puts a lot of stock in. The eagerness to understand your situation is one-half of a coin that also includes an eagerness to educate. Your tax advisor should feel very comfortable sharing their expertise with you. This does two things: it helps you better understand what they are doing and what your taxes will look like, and it helps the tax advisor understand where you are at from a comprehension standpoint. Why does comprehension matter? If your tax advisor can help teach you how your taxes work, it will create opportunities throughout the year for you to implement initiatives that improve your tax outlook for the future. Availability, Availability, Availability A phenomenal tax advisor isn’t worth much to you if you …

Latest Updates for 2022 Tax Season & Beyond

You made it! 2021 has ended and it’s time to start looking ahead to the 2022 tax season. Here are the latest updates. Tax Deadlines There are lots of tax deadlines that have already lapsed as 2021 drew to a close, and there are lots more just around the corner. Social Security, Medicare, and withheld income tax are all due on January 18. And January 31 is the deadline to send out forms 1099-NEC. Tax Day this year is still set for April 15, 2022, but that is still subject to change should any new developments in the coronavirus pandemic take place. If you are hoping to get an extension, Form 4868 needs to be filed before April 15, and your tax due date will be pushed back to October 15, 2022. Kentucky taxpayers should also be aware of a recent deadline change in light of the tornadoes that struck certain areas in the state. Victims of the December 10 disasters will have until May 16, 2022, to file individual and business tax returns. ACA Updates ACA Open Enrollment runs from November 1, 2021, to January 15, 2022, so you still have time to enroll or change your marketplace coverage for 2022. There are also new opportunities – like zero-premium plans – for individuals with extremely low-income levels. For more on the ACA changes for 2022, see our previous blog article. 1099-K Updates There are also some changes to 1099-K reporting coming in 2022. If your business or solopreneur gig includes selling products or services on sites like Etsy, eBay, or even Uber, you’ll need to fill out the 1099-K. Right now, online sellers only get these forms if they had 200 or more transactions with a combined $20,000 or more. Starting in the tax year 2022, sellers who have sales totaling $600 or more will be issued this tax form. Inflation Inflation has been a hot topic this year, with rates rising 6.8% in 2021 – the highest jump since 1982. Before these spikes, the IRS had already determined the inflation adjustment rates for tax year 2021 in October 2020. And …

Continue Reading about Latest Updates for 2022 Tax Season & Beyond →