Do you want more time to prepare your federal tax return? Then apply for a filing extension. What is a Filing Extension? Requesting a filing extension means that you are asking the IRS for additional time to file federal tax forms, giving you more time to collect the necessary details to complete them. But, if you owe money to the IRS, the payment deadline will not change, even if you are granted the extension. Also, you will still need to furnish statements to recipients by the deadlines. You can apply for an extension of time to file the following forms: W-2 W-2G 1042-S 1094-C 1095 1097 1098 1099 3921 3922 5498 8027 What are the Requirements for Filing an Extension? To receive an extension, you must need additional time to file your returns accurately. According to the IRS, if you are requesting an extension for Forms W-2 or 1099-MISC reporting NEC only (now 1099-NEC), you must meet one of the following criteria: The filer suffered a catastrophic event in a federally declared disaster area that made the filer unable to resume operations or made necessary records unavailable Death, serious illness, or unavoidable absence of the individual responsible for filing the information returns affected the operation of the filer Fire, casualty, or natural disaster affected the operation of the filer The filer was in the first year of establishment The filer did not receive data on a payee statement such as Schedule K-1, Form 1042-S, or the statement of sick pay required under section 31.6051-3(a)(1) in time to prepare an accurate information return How Can I Request an Extension? To request an extension, you must file Form 8809, Application for Extension of Time To File Information Returns. Currently, to apply for a filing extension for Forms W-2 and 1099, you can only submit the paper form to: Department of the Treasury, Internal Revenue Service Center, Ogden, UT 84201-0209. Learn more from the IRS at this link. When you …

How has Form 1099-MISC Changed with the Return of Form 1099-NEC?

With the return of Form 1099-NEC, Form 1099-MISC is going to look different starting this year, 2020. How Does Form 1099-MISC Look Different? Here are the changes to Form 1099-MISC: Box 7 → Previously used to report non-employee compensation, which has moved to Form 1099-NEC, this checkbox is used to report if a payer made direct sales of $5,000 or more of consumer products to a buyer (recipient) for resale. Box 9 → Formerly used to report the above, this box allows for a dollar amount of crop insurance proceeds. Box 10 → Formerly used to report the above, this box allows for a dollar amount of gross proceeds paid to an attorney. Box 12 → Previously a blank box, this optional box allows for Section 409A deferrals. Box 14 → Formerly used to report gross proceeds paid to an attorney, this box now allows for a dollar amount of non-qualified deferred compensation for a non-employee that violates Section 409A, which is also reported in Box 1 of Form 1099-NEC. Box 15 → Previously split into two parts, “a” and “b,” this box is used to report the dollar amount of state tax withheld. Box 16 → Previously used to report the above, this box is used to note the payer's identification number assigned by the individual state. Box 17 → Formely used to note the above, this box is used to report the dollar amount of state income. As you can see, most of these boxes shifted one “up” and Box 18 was eliminated. View all copies of each form at these links: 2020 and 2019. Dos and Don’ts for Form 1099-MISC Do use Form 1099-MISC for miscellaneous income, such as rents, royalties, and other income. Do report gross proceeds to an attorney (not fees) on Form 1099-MISC. Do report real estate rentals paid for office space for amounts of $600 or more on Form 1099-MISC, unless you pay a real estate agent or property manager; in that case, they should fill out Form 1099-MISC on your behalf. Do complete a 1099-MISC if you made royalty payments of at least $10 during …

Continue Reading about How has Form 1099-MISC Changed with the Return of Form 1099-NEC? →

Form 1099-NEC: What Does It Mean For Your Business?

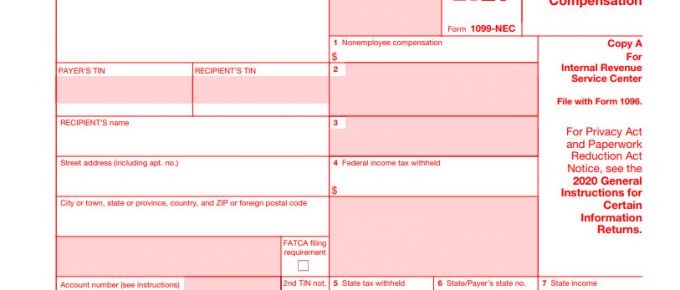

Starting in tax year 2020, Form 1099-NEC replaces former Box 7 on Form 1099-MISC. What Is Form 1099-NEC? This form solely reports Non-Employee Compensation (NEC). It replaces the use of Form 1099-MISC for reporting non-employee compensation (formerly Box 7). The odd thing about Form 1099-NEC is that it’s not a new form at all. It was last used in 1982 but was retired. However, the IRS realized that reporting non-employee compensation on Form 1099-MISC was too complicated because the one form had multiple due dates for various boxes on the form. Learn more about why 1099-NEC returned here. What Is 1099-NEC Used For? Starting in tax season 2020, you will need to fill out Form 1099-NEC if you paid any worker $600 or more during the calendar year in non-employee compensation. This includes: You paid someone who is not your employee You paid for services in the course of your trade or employment You paid an individual, partnership, estate, or corporation Non-employee compensation includes the following payment types to independent contractors: Fees Commissions Prizes Awards Other forms of compensation for services How Do You Fill Out Form 1099-NEC? When filling out Form 1099-NEC, you will need the following information: Business’s name, address, and phone number Business’s TIN (Taxpayer Identification Number) Recipient’s name, address, and TIN Total non-employee compensation Federal and state income tax withheld Like Form 1099-MISC, there are multiple copies of Form 1099-NEC you must distribute: Copy A to the IRS Copy 1 to the State tax department, if applicable Copy B to the independent contractor Copy 2 to the independent contractor for his or her state income tax return Copy C to keep in your business records You can file Form 1099-NEC electronically or by mail. What Else Moves From Form 1099-MISC to 1099-NEC? In addition to the typical independent contractor payments, you will now report the following on the 1099-NEC …

Continue Reading about Form 1099-NEC: What Does It Mean For Your Business? →

2021 Tax Prep for Small Businesses

Tax season is a good time to think about tax preparation for the next year. There may have been unforeseen obstacles you encountered with filing this year that you can avoid next time. Since many of us are working from home due to stay-at-home orders because of the pandemic, our new reality will shift our tax preparation process, so it’s important to start noting changes and differences now, before you go to file. Now that your 2019 taxes are filed, it’s time to start preparing to file your 2020 taxes in 2021. We’ll take you through the step-by-step process on how to do just that. File the right tax return for your business Know your tax filing deadline Gather your records Look for tax deductions Deduct your estimated tax payments File your taxes File the Right Tax Return For Your Business There are different tax returns based on the size and needs of your business. Choosing the right tax form depends on how you operate your small business. Sole Proprietorship Schedule C Schedule C-EZ, Form 1040 (individual income tax return) Limited Liability Company (LLC) Form 1065 (return of partnership income) Form 1040 (individual income tax return) Schedule C (a Schedule C is only used if one person owns 100 percent of the LLC business) Partnerships Form 1065 (return of partnership income) Form 1040 (individual income tax return) S Corporation Form 1120S (income tax return for S corporation) Form 1040 (individual income tax return) Schedule K-1 (individual owner shares) Additionally, the IRS requires businesses who made or received payments for certain transactions to file an information return. Information returns are not income tax returns but are a requirement for reporting purposes to assist other taxpayers in preparing their return. Examples include: 1099s, 1098s, 1095s and W-2s. Know Your Tax Filing Deadline Although the IRS extended the deadline this year for …

Modernizing Information Returns

Last year, the Internal Revenue Service (IRS) launched a multi-year modernization plan to strengthen cybersecurity protections and improve how the agency engages with taxpayers. Through the IRS Modernization Plan, the federal agency will focus on advancing technology systems and building critical infrastructure for the country’s tax system. Included in the plan is an effort to update systems that process information returns, which are used for tax verification and reporting transactions to the IRS. The Information Returns Processing (IRP) environment processes information returns filed by third parties like employers, financial institutions, educational institutions and other government agencies. The current system uses an intake system through paper or electronic submission, validates data and then updates accounts for compliance and analytics. The IRP environment works but is no longer able to accommodate new requirements. The new modernization effort is needed because old systems are unable to handle a series of legislative mandates such as the Affordable Care Act and Tax Reform Act. The Information Returns Program Development (IRPD) aims to address this re-engineering challenge with seven objectives: Create a modern and flexible solution for acceptance, validation, perfection, management, and use of Information Returns Data. Replace aging systems with modern, adaptive, and sustainable technologies. Use Information Returns Data to support enhanced compliance processes. Consolidate, standardize and simplify Intake and Validation systems for Information Returns. Establish a new design for IR Processing to support new types of Information Returns. Improve data access and data integration for downstream systems. Develop a foundation for streamlining operations. In addition to seeing updates in how information returns are filed, we’ll also see emerging priorities and advances across the system under the four Modernization …

3 Tips to Avoid Penalties and Filing Errors

There are more than 40 types of information returns that the Internal Revenue Service (IRS) requires to be filed. Information returns are vital to reporting and verifying income tax in the U.S. and matching individual tax returns to determine compliance. Filing the correct returns in a timely manner is contingent upon having correct information to remain within compliance. Failure to file on time or with incorrect information may result in penalties charged to taxpayers (if they don’t immediately make the correction) or you, the preparer, for failure to comply with an information reporting requirement. Some errors are easier to fix than others. The IRS penalizes based on the size of business, type of failure and tardiness of filing. Avoid errors and potential penalties with these tips: File by the due date. Business tax returns are due based on your business type and most information forms are required to be e-filed or mailed by a specific date every year. Missing the due date for your business tax return will cost you. The penalty is five percent each month the return is late and can be a maximum of 25 percent. If you file more than 60 days after the due date, the minimum penalty is $135 or 100 percent of the tax return. For sole proprietors and single-member LLCs, penalties and fines are based on the amount underpaid or paid late and will not stop accruing interest until the balance is paid in full. → Takeaway: Don’t panic if you cannot pay the full amount of taxes you owe. Submit your return on time and pay at least 90 percent of the tax due to avoid a penalty. Even with an extension, you must estimate how much you owe, if anything, and send in that amount by the due date. Ensure correct spelling and Tax ID Number (TIN) The IRS penalizes for reporting incorrect taxpayer ID on information returns. If the (TIN) is incorrect or missing, the taxpayer is subject to backup withholding and you’ll get a backup withholding notice. → Takeaway: …

Continue Reading about 3 Tips to Avoid Penalties and Filing Errors →