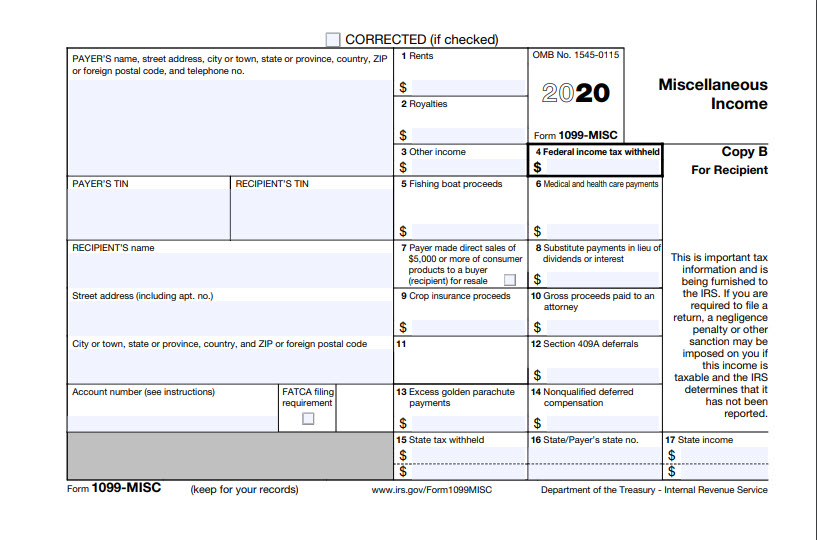

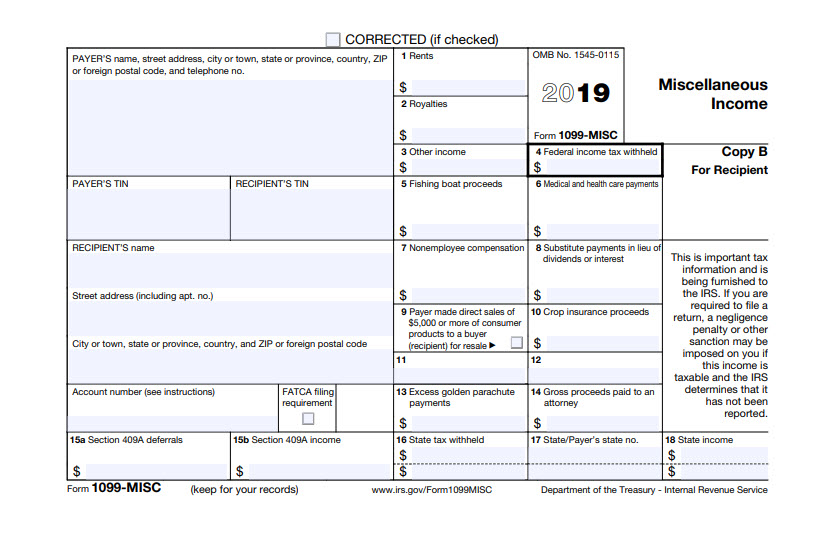

With the return of Form 1099-NEC, Form 1099-MISC is going to look different starting this year, 2020.

How Does Form 1099-MISC Look Different?

Here are the changes to Form 1099-MISC:

- Box 7 → Previously used to report non-employee compensation, which has moved to Form 1099-NEC, this checkbox is used to report if a payer made direct sales of $5,000 or more of consumer products to a buyer (recipient) for resale.

- Box 9 → Formerly used to report the above, this box allows for a dollar amount of crop insurance proceeds.

- Box 10 → Formerly used to report the above, this box allows for a dollar amount of gross proceeds paid to an attorney.

- Box 12 → Previously a blank box, this optional box allows for Section 409A deferrals.

- Box 14 → Formerly used to report gross proceeds paid to an attorney, this box now allows for a dollar amount of non-qualified deferred compensation for a non-employee that violates Section 409A, which is also reported in Box 1 of Form 1099-NEC.

- Box 15 → Previously split into two parts, “a” and “b,” this box is used to report the dollar amount of state tax withheld.

- Box 16 → Previously used to report the above, this box is used to note the payer’s identification number assigned by the individual state.

- Box 17 → Formely used to note the above, this box is used to report the dollar amount of state income.

As you can see, most of these boxes shifted one “up” and Box 18 was eliminated.

View all copies of each form at these links: 2020 and 2019.

Dos and Don’ts for Form 1099-MISC

- Do use Form 1099-MISC for miscellaneous income, such as rents, royalties, and other income.

- Do report gross proceeds to an attorney (not fees) on Form 1099-MISC.

- Do report real estate rentals paid for office space for amounts of $600 or more on Form 1099-MISC, unless you pay a real estate agent or property manager; in that case, they should fill out Form 1099-MISC on your behalf.

- Do complete a 1099-MISC if you made royalty payments of at least $10 during the year.

- Don’t report non-employee compensation on Form 1099-MISC starting in 2020. Instead, use Form 1099-NEC.

- Don’t use Form 1099-MISC to report personal payments.

- Don’t use Form 1099-MISC to report employee wages; use Form W-2 instead.

- Don’t use Form 1099-MISC to report business travel allowances paid to employees; this may be reportable on Form W-2.

How Do Forms 1099-MISC and 1099-NEC Overlap?

For some line items, you will need to input information on both forms.

As shown above, attorney payments will be reported on both forms. However, what you report may differ based on the services provided by the attorney. When an attorney provides services related to specific litigation matters, report the payment in Box 10 of Form 1099-MISC. When the same attorney performs services related to general business matters, report the payments on Form 1099-NEC.

When Are Forms 1099-MISC and 1099-NEC Due?

Form 1099-MISC is due to the IRS on or before March 1, 2021, if you file on paper, or March 31, 2021, if you file electronically. (Normally it’s February 28, but in 2021, February 28 falls on a Sunday.)

Form 1099-NEC is due to the IRS on or before February 1, 2021, using either paper or e-filing.

E-file 1099-NEC and 1099-MISC forms with eFile360. Sign up for a free account here.