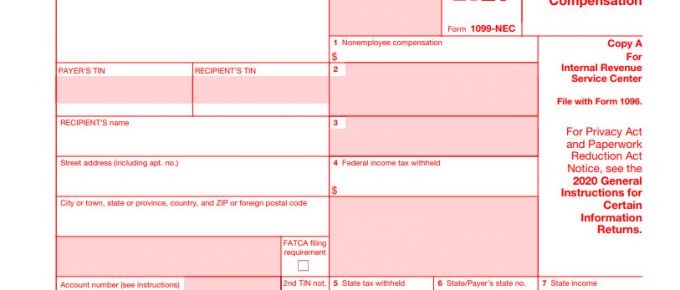

If you were hired as a freelancer or independent contractor and your total earnings were more than $600, you will need to file taxes using the renewed 1099-NEC form for the tax year 2020. What is an Independent Contractor? An independent contractor is a person or business that provides goods or services under contract or verbal agreement. Though this agreement means the independent contractor works for another company, the independent contractor is not considered an employee of that company. Being an independent contractor gives you the freedom to set your own schedule or to supplement your day job income, but that means you are the only one responsible for tracking and reporting those freelance earnings on your taxes. Here are some tips to help you when filing as an independent contractor. 1099-MISC vs 1099-NEC 1099 forms are the most common forms used by businesses that hire independent contractors. In the past, Box 7 on the 1099-MISC is where businesses reported their payments to contractors, but starting in the tax year 2020, the IRS has renewed the 1099-NEC (non-employee compensation) form and that is going to take the place of the 1099-MISC for freelance wage reporting. Self-Employment Taxes Self-employment taxes are taxes consisting of Social Security and Medicare taxes for individuals who work for themselves - since you don’t have an “employer”, you have to account for these taxes yourself if you are an independent contractor. You determine your self-employment tax using Schedule SE on the Form 1040 or 1040-SR. The self-employment tax rate is 15.4% and consists of two parts: 12.4% for social security and 2.9% for Medicare. For 2020, according to the IRS, the first $137,700 “of your combined wages, tips, and net earnings are subject to any combination of the Social Security part of self-employment tax, Social Security Tax, or railroad retirement (tier 1) tax.” Self-employment taxes tend to be higher than traditional employee taxes …

Continue Reading about Filing As an Independent Contractor →