The IRS has re-introduced the 1099-NEC form for reporting non-employee compensation in an effort to smooth out the reporting process for contract labor and other related costs. Here are some of the main dos and don’ts of filing 1099-NEC. Do: File 1099-NEC Forms for Non-Employee Compensation The IRS requires reporting payments that are: made to someone who is not your employee, made for services in the course of trade or business dealings, or payments over $600 for the calendar made to an individual, partnership, estate, or even sometimes a corporation. Some examples of this include professional service fees to attorneys, accountants, or architects, fees paid between two professionals, payments for services, even parts and materials, and commissions. Don’t: Report Exceptions These exceptions do not need to be reported: payments for phone, freight, telegrams, storage, or merchandise and the like and payments for a foreign government, tax-exempt organizations, tax-exempt trusts, and payments to governments at the federal, state, and local levels. Do: Verify Recipient Taxpayer ID One of the first things you need to do is verify each recipient’s taxpayer ID. In order to complete the 1099-NEC for your contract workers, you must also have a form W-9 given to you by each recipient. Don’t: Use Form 1099-NEC for Personal Payments A big thing to remember about the new 1099-NEC form reporting is: don’t use the form 1099-NEC to report personal payments. Do: Mind Your Due Dates When filing and submitting these forms, remember the due date to distribute 1099-NECs to recipients is January 31 – though this date falls on a Sunday for 2021, so February 1 will be the deadline for the year. You must also be sure to file with the IRS by January 31 (again, February 1 for the year 2021). Don’t: Use Form 1099-NEC for Employee Wages In the same way that personal payments aren’t reported on the 1099-NEC, this form is also not for reporting employee wages. Make sure not to …

Federal and State Filing for 1099-NEC

For the 2020 tax year, form 1099-NEC has a filing due date of February 1, since January 31 falls on a Sunday in 2021. This date is for paper and electronic filing. 2020 is filled with apprehension as businesses scramble to stay afloat amid the COVID-19 crisis The revived 1099-NEC form may not be a big concern right now, but as the deadline for filing gets closer, you will have questions about this “new” form in regards to the state, federal, and possibly combined filing. How does the 1099-NEC Change State Filing? The introduction of the 1099-NEC form in addition to the 1099-MISC will change how businesses report and file non-employee compensation. Though the changes seem minimal, navigating which forms to use and when may prove more nuanced than initially thought. According to the American Payroll Association, in the coming months, “state tax authorities will most likely be revising regulations, forms, and instructions to adopt the new federal Form 1099-NEC or states may choose to retain their form 1099-MISC equivalent for reporting NEC.” States will have to figure out how best to incorporate this new form just as businesses will. It’s also good to keep in mind that the Taxpayer First Act prohibits many businesses from submitting more than 100 paper forms. The addition of the 1099-NEC requirements could mean your business must now submit forms electronically if you have not done so in the past. Can You Combine Federal and State Filing for 1099-NEC? Though many 1099 forms, including 1099-MISC returns, can be filed through the Combined Federal/State Filing (CF/SF) program using the FIRE System, the same is not yet true for the new 1099-NEC. Since the 1099-NEC has not been used since the 1980s, states have been using the 1099-MISC for all NEC reporting. Because the 1099-NEC filing due date is January 31 in most states, businesses will need to create a procedure to separate the appropriate information and report on either the 1099-NEC or …

Continue Reading about Federal and State Filing for 1099-NEC →

Form 1099-NEC Best Practices for CPAs

As a CPA, if you’re preparing Form 1099-NEC for your clients, then you need to know the latest best practices. Start preparing for tax year 2020 now with these tips. Review How Your Clients’ Income is Mapped With the return of Form 1099-NEC, you will need to pay close attention to how you map your clients’ income. You will need to adjust how you map their income and adjust your routine from previous years to split non-employee compensation and other miscellaneous payments. Ideally, you will map out whether your current process for Form 1099-MISC is accurate, adjust it accordingly, and then split off the necessary variables for Form 1099-NEC. Accurately mapping your clients’ income ensures that you report the correct amounts on the right forms at the right time. Specific situations that you may want to pay close attention to include: Lawyer payments Other income Real estate payments, such as rent Be Aware of Penalty Increases Among the many changes that the return of Form 1099-NEC brings, the penalties are changing, too. In general, they continue to increase for late or inaccurate reporting. Find out more about 1099 penalties here. According to Moss Adams, “For 2019 filings, penalties are applied at $50 for information return reports filed after the deadline but within 30 days, and they increase to $110 for returns filed after 30 days beyond the deadline but before August 1, 2020. Information return reports filed incorrectly after August 1, 2020, or not at all, will have a penalty of $270 per form.” Encourage Payment and Withholding Tracking Whether you’re meeting with clients before tax year 2020 or not, it’s important to inform them that they need to separately track nonemployee compensation and other 1099 payments. The sooner you tell your clients this and show them how to do so, the easier the next tax season will be for you and your clients. Equally as important is to note the difference for state income and withholding as it …

Continue Reading about Form 1099-NEC Best Practices for CPAs →

Examples of When to Use Form 1099-NEC

Form 1099-NEC doesn’t have to be confusing. Here are practical examples of using Form 1099-NEC. If you need to catch up on what Form 1099-NEC is and how it changes Form 1099-MISC, read these first: What’s the New 1099-NEC for Non-Employee Compensation? How has Form 1099-MISC Changed with the Return of Form 1099-NEC? Form 1099-NEC: What Does It Mean For Your Business? When to Use Form 1099-NEC When You Pay Fees for Professional Services When you pay for professional services, you will likely report this on Form 1099-NEC. This includes fees paid to attorneys – even when the law firm or individual is a corporation – as well as fees paid to accountants, architects, engineers, and consultants. According to Sovos, you may create two 1099 forms for the same attorney for different legal services. These forms will likely have different numbers on them. When you work with an attorney for a specific litigation, you will report your payments on Form 1099-MISC in Box 10 Gross Proceeds Paid to an Attorney. If you use the same law firm for general purposes – including contract reviews and potential legal issues concerning your employees – you will report your payments on Form 1099-NEC. Incidentals When you pay for other services and part of the payment covered incidentals – the cost of parts or materials used to perform the services – you will complete Form 1099-NEC. When You Pay Commission If you have salespeople, you likely pay them a commission. If they do not repay this commission during the year, you will report the total payment on Form 1099-NEC. If You Sold $5,000 or More in Consumer Products According to the IRS, if your made direct “sales of $5,000 or more of consumer products to a person on a buy-sell, deposit-commission, or other commission basis for resale (by the buyer or any other person) anywhere other than in a permanent retail establishment,” you will enter an “X” in Box 7 of Form 1099-MISC. With this form, you may also need …

Continue Reading about Examples of When to Use Form 1099-NEC →

How has Form 1099-MISC Changed with the Return of Form 1099-NEC?

With the return of Form 1099-NEC, Form 1099-MISC is going to look different starting this year, 2020. How Does Form 1099-MISC Look Different? Here are the changes to Form 1099-MISC: Box 7 → Previously used to report non-employee compensation, which has moved to Form 1099-NEC, this checkbox is used to report if a payer made direct sales of $5,000 or more of consumer products to a buyer (recipient) for resale. Box 9 → Formerly used to report the above, this box allows for a dollar amount of crop insurance proceeds. Box 10 → Formerly used to report the above, this box allows for a dollar amount of gross proceeds paid to an attorney. Box 12 → Previously a blank box, this optional box allows for Section 409A deferrals. Box 14 → Formerly used to report gross proceeds paid to an attorney, this box now allows for a dollar amount of non-qualified deferred compensation for a non-employee that violates Section 409A, which is also reported in Box 1 of Form 1099-NEC. Box 15 → Previously split into two parts, “a” and “b,” this box is used to report the dollar amount of state tax withheld. Box 16 → Previously used to report the above, this box is used to note the payer's identification number assigned by the individual state. Box 17 → Formely used to note the above, this box is used to report the dollar amount of state income. As you can see, most of these boxes shifted one “up” and Box 18 was eliminated. View all copies of each form at these links: 2020 and 2019. Dos and Don’ts for Form 1099-MISC Do use Form 1099-MISC for miscellaneous income, such as rents, royalties, and other income. Do report gross proceeds to an attorney (not fees) on Form 1099-MISC. Do report real estate rentals paid for office space for amounts of $600 or more on Form 1099-MISC, unless you pay a real estate agent or property manager; in that case, they should fill out Form 1099-MISC on your behalf. Do complete a 1099-MISC if you made royalty payments of at least $10 during …

Continue Reading about How has Form 1099-MISC Changed with the Return of Form 1099-NEC? →

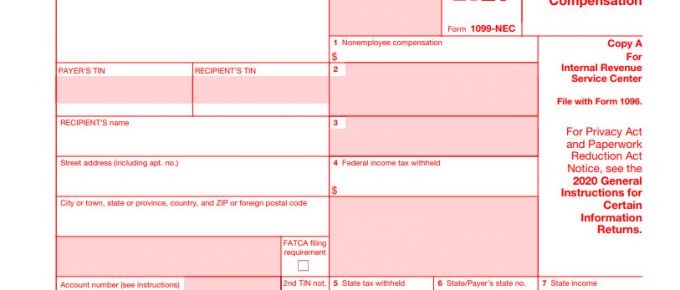

Form 1099-NEC: What Does It Mean For Your Business?

Starting in tax year 2020, Form 1099-NEC replaces former Box 7 on Form 1099-MISC. What Is Form 1099-NEC? This form solely reports Non-Employee Compensation (NEC). It replaces the use of Form 1099-MISC for reporting non-employee compensation (formerly Box 7). The odd thing about Form 1099-NEC is that it’s not a new form at all. It was last used in 1982 but was retired. However, the IRS realized that reporting non-employee compensation on Form 1099-MISC was too complicated because the one form had multiple due dates for various boxes on the form. Learn more about why 1099-NEC returned here. What Is 1099-NEC Used For? Starting in tax season 2020, you will need to fill out Form 1099-NEC if you paid any worker $600 or more during the calendar year in non-employee compensation. This includes: You paid someone who is not your employee You paid for services in the course of your trade or employment You paid an individual, partnership, estate, or corporation Non-employee compensation includes the following payment types to independent contractors: Fees Commissions Prizes Awards Other forms of compensation for services How Do You Fill Out Form 1099-NEC? When filling out Form 1099-NEC, you will need the following information: Business’s name, address, and phone number Business’s TIN (Taxpayer Identification Number) Recipient’s name, address, and TIN Total non-employee compensation Federal and state income tax withheld Like Form 1099-MISC, there are multiple copies of Form 1099-NEC you must distribute: Copy A to the IRS Copy 1 to the State tax department, if applicable Copy B to the independent contractor Copy 2 to the independent contractor for his or her state income tax return Copy C to keep in your business records You can file Form 1099-NEC electronically or by mail. What Else Moves From Form 1099-MISC to 1099-NEC? In addition to the typical independent contractor payments, you will now report the following on the 1099-NEC …

Continue Reading about Form 1099-NEC: What Does It Mean For Your Business? →